A Comprehensive Guide to Loan Providers and Terms: Which loan will you apply for?

When it comes to managing our finances, having access to reliable banking services is crucial. In the Philippines, several prominent banks and financial institutions offer a wide range of products and services to cater to various financial needs. In this article, we will provide an overview of four notable banks: Tonik, Citibank, Metrobank, and Goodloan. Understanding the features and offerings of these institutions will empower you to make informed decisions about your banking needs.

1.Tonik: A Digital Banking Experience

Tonik is a digital bank that provides a modern and convenient banking experience to its customers. Leveraging technology, Tonik offers a range of financial services, including deposit accounts, loans, and more. Key features of Tonik include:

a) Loan Options: Tonik offers loans ranging from ₱5,000 to ₱5 million, catering to both small and large financial requirements. With flexible loan terms of 6 to 60 months, borrowers have the freedom to choose a repayment period that suits them best.

b) Competitive Interest Rates: Tonik offers competitive interest rates, with its Tonik Big Loan product having an attractive monthly add-on rate of 0.5825% (6.99% APR - Fixed). The interest rates for other loan products may vary.

c) Digital Accessibility: Tonik operates primarily through a user-friendly mobile app, providing customers with easy access to their accounts, transactions, and banking services anytime, anywhere.

To know more about what Tonik can offer and their wide variety of services, you may visit their website by clicking this link 👉🏻Tonik Bank.

2.Citibank: International Banking Excellence

Citibank is a renowned international bank known for its comprehensive financial services and global presence. Here are the key highlights of Citibank:

a) Loan Flexibility: Citibank offers loans ranging from ₱5,000 to ₱2 million, covering a broad range of financial needs. With loan terms spanning from 12 to 60 months, borrowers can select a repayment period that aligns with their financial goals.

b) Competitive Interest Rates: Citibank provides competitive interest rates, starting at 1.29% per month. These rates make their loan offerings attractive to those seeking competitive financing options.

c) Established Reputation: As a trusted international bank, Citibank offers a wide range of financial products and services, combining global expertise with local market knowledge.

3.Metrobank: Established Banking Tradition

Metrobank, one of the largest and most prominent banks in the Philippines, has built a solid reputation for its comprehensive suite of banking services. Here are the key features of Metrobank:

a) Loan Diversity: Metrobank offers loans ranging from ₱5,000 to ₱1 million, catering to moderate-sized financial requirements. With loan terms spanning from 12 to 36 months, borrowers have flexibility in choosing their repayment duration.

b) Competitive Interest Rates: Metrobank provides competitive interest rates, starting at 1.25% per month. The specific rate may vary based on the loan term, enabling borrowers to select an option that suits their financial capabilities.

c) Established Branch Network: Metrobank has an extensive network of branches across the Philippines, ensuring convenient access to banking services for customers.

4.Goodloan: Specialized Loan Products

Goodloan offers specialized loan products tailored to specific needs. While limited information is provided, here are some key aspects of Goodloan:

a) Purpose-Specific Loans: Goodloan offers loan products such as the MC Maintenance Loan and Mini Puhunan Loan, designed to address specific purposes. These loans may be suitable for borrowers seeking financing for maintenance or small business capital.

b) Specific Loan Amounts: Goodloan provides predetermined loan amounts for each product, they can provide a PHP 3000 up to PHP 20,000 depending upon your repayment records.

c) Interest Rates and Loan Terms: Goodloan's interest rates differ depending on the specific loan product. For example, the MC Maintenance Loan has a monthly add-on rate of 3.5%.

To illustrate further, here are the comprehensive details of all the banks mentioned above:

Loan Amount Range: ₱5,000 to ₱50,000

1.Tonik Quick Loan

- Loan Amount: ₱5,000 to ₱50,000

- Loan Terms: 6, 9, 12, 18, and 24 months

- Monthly Add-On/Contractual Rate: Annual Percentage Rate (APR) is at 84%

2.Tonik Flex Loan:

- Loan Amount: ₱20,000 to ₱50,000

- Loan Terms: 6, 9, 12, 18, and 24 months

- Monthly Add-On/Contractual Rate: 2.49%

3.Citibank

- Loan Amount: ₱20,000 to ₱50,000

- Loan Terms: 12, 24, 36, 48, and 60 months

- Monthly Add-On/Contractual Rate: 1.29%

4.Metrobank

- Loan Amount: ₱20,000 to ₱50,000

- Loan Terms: 12, 18, 24, and 36 months

- Monthly Add-On/Contractual Rate: 1.25%, 1.5%, or 1.75%, depending on the loan term

5.Goodloan - MC Maintenance Loan:

- Loan Amount: ₱50,000

- Loan Term: Not specified

- Monthly Add-On/Contractual Rate: 3.5% per month interest rate

6.Goodloan - Mini Puhunan Loan:

- Loan Amount: ₱20,000 to ₱50,000

- Loan Term: 15 days

- Monthly Add-On/Contractual Rate: 2.25%

Loan Amount Range: ₱50,000 to ₱250,000

1.Tonik Flex Loan

- Loan Amount: ₱50,000 to ₱250,000

- Loan Terms: 6, 9, 12, 18, and 24 months

- Monthly Add-On/Contractual Rate: 2.49%

2.Citibank

- Loan Amount: ₱50,000 to ₱250,000

- Loan Terms: 12, 24, 36, 48, and 60 months

- Monthly Add-On/Contractual Rate: 1.29%

3.Metrobank

- Lan Amount: ₱50,000 to ₱250,000

- Loan Terms: 12, 18, 24, and 36 months

- Monthly Add-On/Contractual Rate: 1.25%, 1.5%, or 1.75%, depending on the loan term

4.Goodloan - Motorcycle Loan:

- Loan Amount: ₱50,000 to ₱250,000

- Loan Term: 36 months

Loan Amount Range: ₱250,000 to ₱1,000,000

1.Tonik Big Loan

- Loan Amount: ₱250,000 to ₱1,000,000

- Loan Terms: 12, 24, 36, 48, and 60 months

- Monthly Add-On/Contractual Rate:0.5825% (6.99% ARP - Fixed)

2.Citibank

- Loan Amount: ₱250,000 to ₱1 million

- Loan Terms: 12, 24, 36, 48, and 60 months

- Monthly Add-On/Contractual Rate: 1.29%

3.Metrobank

- Loan Amount: ₱250,000 to ₱1 million

- Loan Terms: 12, 18, 24, and 36 months

- Monthly Add-On/Contractual Rate: 1.25%, 1.5%, or 1.75%, depending on the loan term

Loan Amount Range: ₱1 Million to ₱5 Million

1.Tonik Big Loan

- Loan Amount: ₱1 million to ₱ 5 million

- Loan Terms: 12, 24, 36, 48, and 60 months

- Monthly Add-On/Contractual Rate: 0.5825% (6.99% APR - Fixed)

2.Citibank

- Loan Amount: ₱1 million to ₱2 million

- Loan Terms: 12, 24, 36, 48, and 60 months

- Monthly Add-On/Contractual Rate: 1.29%

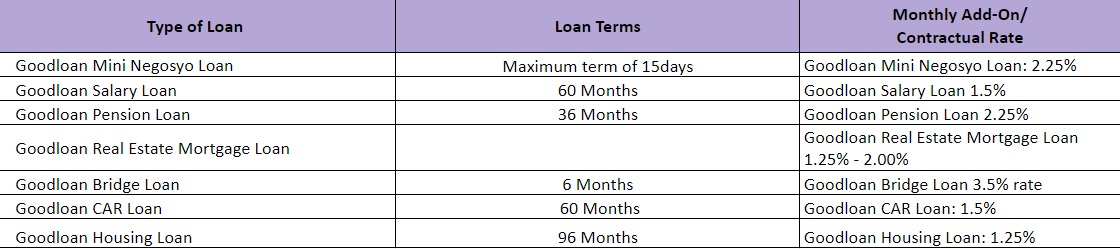

While the above listings include Goodloan at some point, here is the full list of Goodloan's different loan offers with their terms and rates:

You can manage your finances more effectively if you are aware of the features and services that different banks offer. Each company—Tonik, Citibank, Metrobank, and Goodloan—brings to the table specific advantages and qualities. While Citibank combines global expertise with a wide range of financial services, Tonik offers a digital banking experience at competitive rates. Metrobank is a reputable bank with a wide range of services, and Goodloan offers specialized loan products that are catered to particular requirements. You can find the bank that best suits your financial needs and aspirations by exploring these options.

-------------------------------------------------------------

Links 🔗

Tonik: https://tonikbank.com/

Citibank: https://www.citibank.com.ph/

Metrobank: https://www.metrobank.com.ph/

Security Bank: https://www.securitybank.com.ph/

Goodloan: https://www.goodloan.com.ph/

- #home loan philippines

- #home loan interest rates philippines

- #bank loan