How the Monopoly Game Reflects the Real Estate Market

The Monopoly game has a rich history that can be traced back to American anti-monopolist Lizzie Magie, credited with creating "The Landlord's Game" in 1903, designed to illustrate the negative impact of monopolies. This game later evolved into the Monopoly game loved by millions worldwide. While many people believe Charles Darrow was the inventor, it was Magie who laid the foundation for it. Darrow is credited with modifying the design and rules to make it more appealing to a wider audience and then selling it to Parker Brothers for mass production. The game revolves around the buying and selling of properties, building houses and hotels to generate income. Although it is a fun game to play with friends and family, it also reflects certain aspects of the real estate market.

Market dominance advantage

One of the most obvious ways in which Monopoly reflects the real estate market is through the concept of property ownership. In the game, players compete to own as many properties as possible, and the more properties they own, the more money they can make. This is similar to the real estate market, where property ownership is a key factor in generating wealth. Market dominance advantage can provide benefits for firms that have a controlling position, such as the ability to set higher prices and dictate more favorable terms to other market participants. This dominance advantage can create high barriers to entry for potential competitors, contributing to a lack of competition and reduced innovation in the industry. However, as market conditions change and more innovative players enter the market, established firms may need to adapt to maintain their position of dominance over time.

Location! Location! Location!

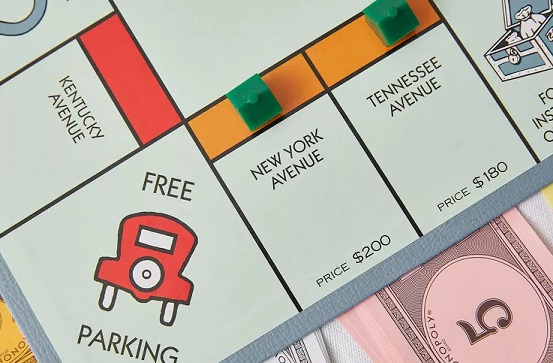

Another way in which Monopoly reflects the real estate market is through the concept of location. In the game, some properties are more valuable than others, statistically speaking, the Orange and Red properties are landed on most frequently during the game, according to several Monopoly strategy guides. Owning these properties can generate higher rent fees and increase your chance of winning. Therefore, it is advisable to focus on buying those properties in order to gain an advantage. Additionally, the player who owns the most red and orange properties may be more likely to win in the long run.

Similarly, in the real estate market the location is a key factor in the real estate market as it has an impact on the value and demand of the property. The value of a property is largely determined by its location, which varies in desirability. Properties in prime locations such as near schools, decent infrastructure, public transport or in the city center tend to have higher demand and values than those located in less favorable areas like those with poor infrastructure, high crime rates, or far from essential amenities. The proximity to essential amenities is attractive to buyers and renters as it improves daily living and reduces transportation costs, making it more attractive to potential tenants or buyers. A location can also affect the potential for growth in property value as areas expected to see economic growth, such as new commercial developments, tend to experience an increase in property demand and value.

Return Of Investment (ROI)

ROI and yield are commonly used metrics in the real estate market to evaluate a property's profitability. ROI is calculated by dividing the total return on the investment by the total cost of the investment, expressed as a percentage. Yield is the ratio of the annual rental income to the total cost of the investment, measuring the potential cash flow from the property. These metrics serve as important tools for evaluating the performance of a property investment and making informed decisions for future investments. It is crucial to note that ROI and yield calculation can vary depending on the property, real estate market, and investor's goals.

While in a Monopoly game, it is advisable to invest in properties and develop them with houses and hotels. Saving money, especially early in the game when properties are not fully developed, is not beneficial as it will not contribute to winning. The money in the bank is not invested and earns nothing since there is no interest yielding, so it is essential to keep minimal amounts in the bank at all times and look for opportunities to invest cash in purchasing properties. Investing in properties provides the chance to deliver returns and increase one's chances of winning the game. Surprisingly, many professional Monopoly players don't see the value in purchasing utilities. This is due to the low probability of earning a profit from the railroads or utilities throughout the game, which stands at only 3%. Additionally, unlike other color-coded properties, utilities cannot be upgraded. If you calculate the ROI of investing in utilities, it becomes evident that it is not a good investment.

Supply and Demand

Monopoly is a game that demonstrates the concept of supply and demand. Players can increase the value of their properties by building houses and hotels, which in turn increases the demand for their properties. About the classic rule of the original game, a lesser-known fact is the "Housing Shortage" rule, which stipulates that once 32 houses have been placed on the board, no more can be bought. Therefore, by quickly buying all of the houses, a player can dominate their opponents with ease. If a player has one or two monopolies and no one else has a monopoly, a more strategic approach is to attempt to shorten the housing market. With 32 houses on the board, no more houses can be built, and they will be well on their way to outlasting the competition.

This is similar to the real estate market, where increasing the supply of housing can drive down prices, while increasing demand can drive up prices. Construction companies can also diversify their portfolio by building properties in different segments of the market (e.g., commercial, residential, industrial) to hedge against any downturns in specific segments.

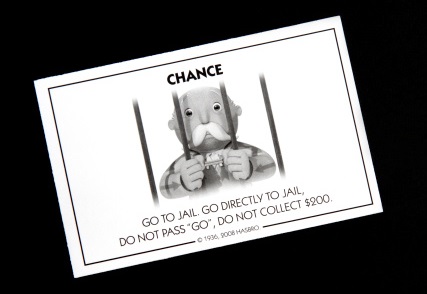

Safeguarding Your Assets

When you land in jail later in the game with hotels filling the board, it's advisable to stay there for your entire three turns (unless you roll a double) until you get out of jail. This strategy can help you save money because if you're running low on cash, you won't have to give your remaining savings to your competitors by landing on their monopolies. Applying this counter-intuitive strategy can be useful during times of economic instability in the real world as well. Taking a cautious approach to your finances, monitoring your expenses, and preserving your resources can help you weather the storm. Moreover, waiting for opportunities can lead to better long-term returns on investment.

According to the article in Cobizmag which discusses the US real estate market, warehousing is considered as a safe investment in real estate portfolios. Additionally, a warehouse space is a great choice for real estate investors across the board but it is important to do thorough research before making any investment decision, If you're interested in investing in a warehouse in the Philippines, we invite you to read our article - Philippine Warehouse Investment Guide and contact us for further details.

Follow The Rules

Have you ever declined a game of Monopoly because it takes too long? You're not alone. According to Monopoly manufacturer Hasbro, the longest game of Monopoly lasted for 70 consecutive days. That's certainly a lot of time to invest! An average game of Monopoly should last around 45 minutes. With only two players, the game is often (but not always) quicker, while with more than four players, it can take 90 minutes or longer. Shockingly, a survey by Hasbro revealed that 68% of Americans have never even read the Monopoly rules. In the report titled 'Estimating the Probability that the Game of Monopoly Never Ends', estimators even suggest that the probability of the game going on forever is close to 12% because both players have enough money to handle the ups and downs of the dice. Not following the rules is the most common reason why Monopoly takes too long.

Similarly, following rules and regulations is paramount in real world. It can save you time and prevent unexpected issues from arising. Obtaining permits and approvals is important in the real estate and construction industry because it ensures that buildings and projects are safe and comply with local laws and regulations. Permitting and approval processes provide a way for local governments to review proposed projects and ensure that they meet minimum standards for safety, health, and welfare. In addition, obtaining the necessary permits and approvals can help protect property owners and developers from legal liability in the event of accidents or other issues related to construction or renovation projects. Failure to comply with required permits and approvals can result in fines, penalties, and even the halt of construction. And using a licensed real estate broker comes with several benefits. They comply with local laws and regulations, act in their clients' best interests, and provide an added layer of protection by disclosing any potential conflicts of interest. With access to essential resources and networks, such as market data and industry contacts, brokers can make the buying or selling process more efficient, resulting in better outcomes for all parties involved.

In conclusion the Monopoly game has served as a popular form of entertainment that has also taught players several lessons in finance and investing such as the importance of strategic decision-making, risk management, and the value of real estate ownership. Monopoly's creation was intended to provide commentary on income inequality and the economic system of the time, while its many adaptations over the years reflect changing cultural norms. Overall, the cultural significance and enduring popularity of Monopoly speak to its continued relevance as a tool for education and social commentary.

- #monopoly